Right to dividend rights shares and bonus shares to be held in abeyance pending registration of transfer of shares. Punishment for failure to distribute dividends.

The Malaysian Companies Act 2016

Rules for Declaring Dividend by Private Limited Company.

. This article will provide an overview of the CA 2016. As per Section 235 of Companies Act 2013 dividend includes any interim dividend. As per Section 235 of Companies Act 2013 defines the term as including any interim dividend.

The Insolvency and Bankruptcy Code 2016. The dividend will be paid on or around the 30 September 2022 to shareholders on the register on 2 September 2022. Declaration of dividend Subs.

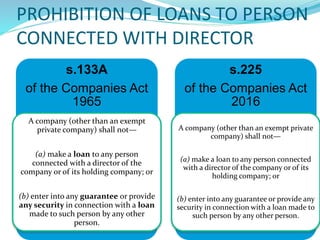

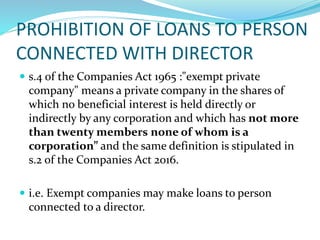

A company can use both of its revenue as well as capital profits to distribute dividend. The Companies Significant Beneficial Owners Rules20l8. To provide loans to any company incorporated under the Companies Act 1965.

Notifies rate of interest in. DIVIDEND- SECTION 235 Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in. The Board of DORE is pleased to declare an interim dividend in respect of the period from 1 April 2022 to 30 June 2022 of 125 pence per Ordinary Share.

Please consult with your own tax advisor for advice with respect to the income tax. Rule 1 to 3. The Investor Education and Protection Fund Authority Appointment of Chairperson and Members Holding Meetings and Provision for Offices and Officers Rules.

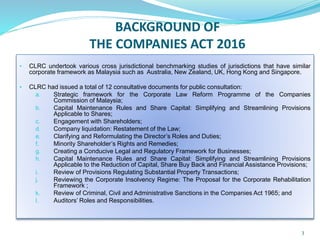

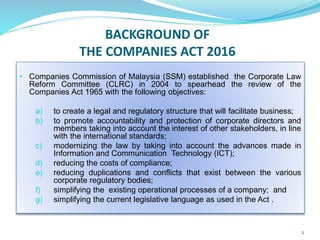

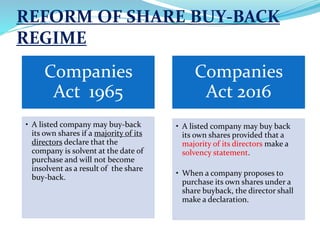

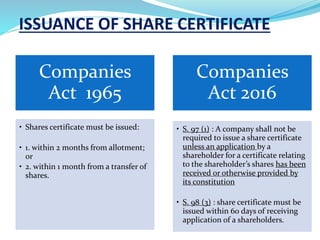

The CA 2016 reformed almost all aspects of company law in Malaysia. As per sub-section 1 of Section. An Act to consolidate and amend the laws relating to reorganisation and insolvency resolution of corporate persons partnership firms and individuals in a time bound manner for maximisation of value of assets of such persons to.

Get all the latest information on London Stock Exchange notices Service Announcements rules and regulations listing forms trading documentation and FAQs. 11 11avii 389 Where and for how long records to be kept. Dividend is a shareholders share in the profits of a company.

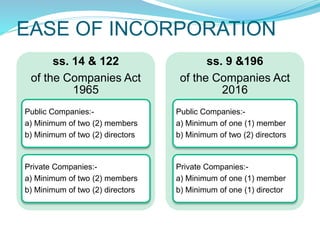

Minimum Number of Members. Rule 1 to 8. Investor Education and Protection Fund.

For purposes of the Income Tax Act Canada and any corresponding provincial and territorial tax legislation all dividends paid by the Corporation are eligible dividends unless otherwise indicated. 162016 on 26 th December 2016 the process of striking off the name of the Company from the Register of Companies through the Fast Track Exit often called FTE stands revisedThe Fast Track Exit mode and. CHAPTER IX ACCOUNTS OF.

SECTION 123 TO 127 OF COMPANIES ACT 2013 READ WITH THE COMPANIES DECLARATION AND PAYMENT OF DIVIDEND RULES 2014. Modified Guidelines in respect of Deregulation of Savings Bank Deposit Interest Rate Dec 28 2011. 1 If a company fails to comply with any provision of subsections 1 to 3 of section 388 requirements as to keeping of accounting records an offence is committed by.

Section 9b CA 2016 Act stipulates that A company shall have one or more. The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia. Dividend can be paid on Equity or.

Act A15042016 At or after the end of the financial year being the 31st December of each year the Board shall with the approval of the Minister declare a dividend on contributions to the Fund in respect of that year- in relation to contributions made by the members of the. Chapter VIII The Companies Declaration and Payment of Dividend Rules 2014. Enquiry or investigation in respect of documentevidence relating to Income Declaration Scheme IDS 2016 found during the course of Search us 132 or Survey action us 133A of the Income-tax Act1961 Sep 07 2016.

2 In terms of sub-sections 1 and 2 of section 17 of the Credit Information Companies Regulation Act 2005 a credit information company may require its members to furnish credit information as it may deem necessary in accordance with the provisions of the Credit Information Companies Regulation Act 2005 and every such credit institution has to. With notification of Section 248-252 by the MCA vide Notification No. Dividend is basically the share of profit distributed among shareholders.

Ordinary meaning of dividend is a share of profits whether at a fixed rate or otherwise allocated to holders of shares in a company. 12072016 25042016 by Team ONS. The ex-dividend date will be 1 September 2022.

DECLARATION AND PAYMENT OF DIVIDEND 123. 388 modified 642016 by The Companies Address of Registered Office Regulations 2016 SI. Dividend amounts and dates are subject to approval by the Board of Directors.

The Malaysian Companies Act 2016

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

The Malaysian Companies Act 2016

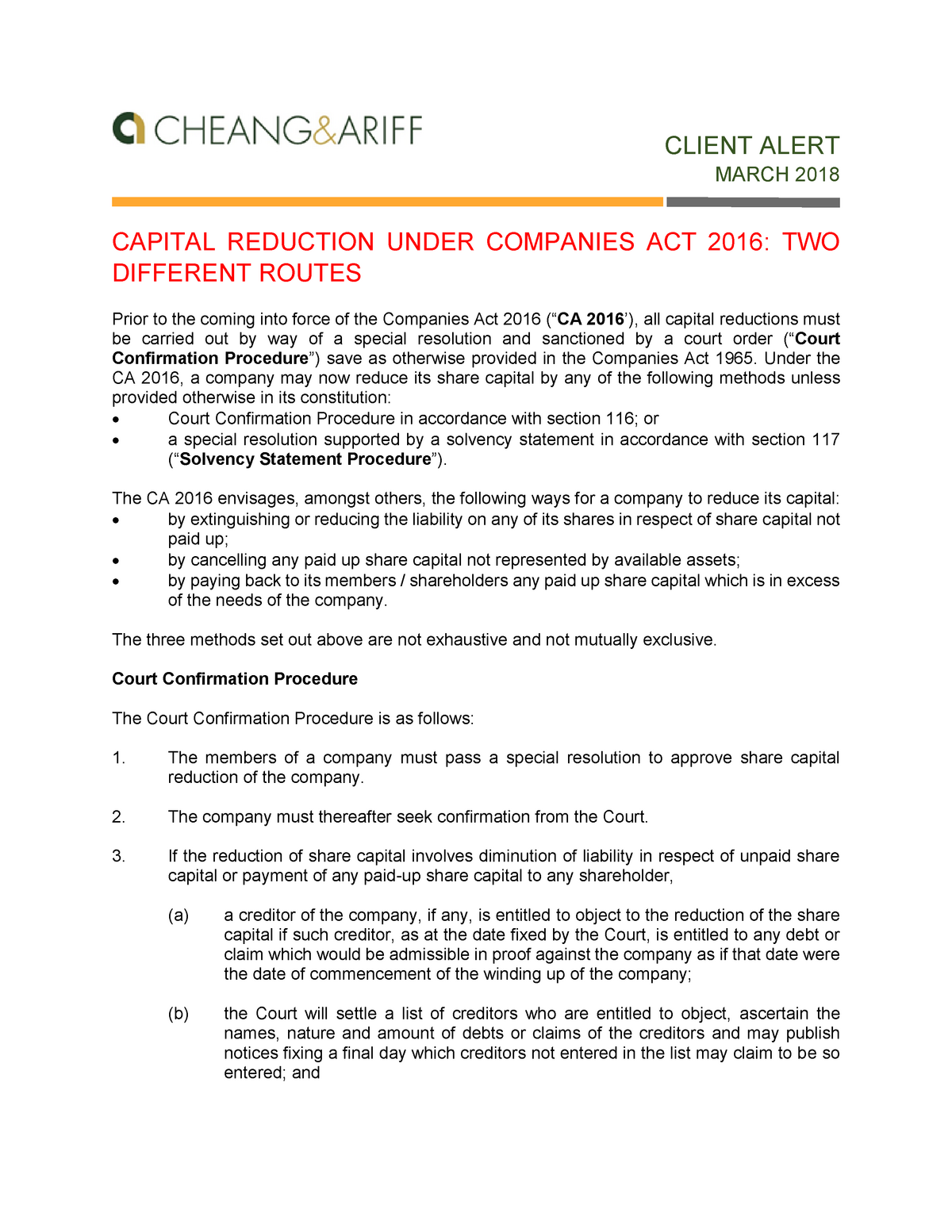

Capital Reduction Under Companies Act 2016 Client Alert March 2018 Capital Reduction Under Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

The Malaysian Companies Act 2016

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

The Malaysian Companies Act 2016

Types Of Preference Shares Preferences Mud Management Finance